The A - Z Of Whatsapp Pay India

India is moving to be digitalized after the campaign of 'Digital India' launched by our honorable PM Narendra Modi. The goal is to carefully engage the nation and its kin, improve the framework, present a superior personal satisfaction, and raise India's height in the worldwide situation.

Many digital payment service provider companies putting their contribution to digitalize India. Facebook-owned chatting app Whatsapp also has jumped in this field and introduced the "Whatsapp pay India" feature. It is an in-chat feature through which a user can send or receive the money.

Facebook, Instagram, Youtube are so popular platforms but Whatsapp is such a platform that is used by a user many times in a day. No matter we are at the parks, classrooms, offices, homes, streets, playgrounds, theaters, etc we use Whatsapp. We use other platforms in specific condition but only Whatsapp is used anywhere, anytime by its 400 million users in India and 2 billion users worldwide.

Whatsapp pay India launch date

Whatsapp pay India was launched in February 2018 for beta testing. At the start, it was tied up with ICICI bank so that it will be tested and brought to dispatch publically. Exactly after two years on 7th February 2020, National Payments Corporation of India (NPCI) gave the approval to roll out its service but in a phased process. Money control mentioned that by May end itt will be accessible in India.

Reason behind delay launch

In the same month when Whatsapp pay India was launched, Centre for Accountability and Systemic (CASC) and non-governmental organization (NGO) filed a petition in the Supreme Court. They claimed that Whatsapp is not assembled with the data localization norms. According to them, users' personal and financial data couldn’t be stored outside in India. Due to such a petition, an initial plan had been held.Banks tied up with Whatsapp pay India

At the start, ICICI bank was tied up with it for beta testing. Now from the sources, it is revealed that Axis bank, HDFC bank, ICICI bank will be tied up with it at the initial level. Sooner State bank of India (SBI) will be added. Due to the necessity of ‘“robust security architecture” SBI would join later.

Benefits / Features of Whatsapp pay India

- It will work on the UPI (Unified Payments Interface) method.

- Bank’s account number and IFSC code will not be required.

- No need to add money in the wallet first and send it.

- Within a few steps payment will be sent.

- QR code scan options will be available as other companies.

- It will allow you to send money to your contact list and also to those who are not there in your contact list.

- The receiver and the sender both will get a notification.

- Easiest interface to use compared to other apps.

How to use Whatsapp pay India?

For a new user, it will require to set UPI at the beginning. This will be a one-time registration process and this configuration process will be the same as other UPI payment apps. Here is the process of setting up the UPI step by step with screenshots.

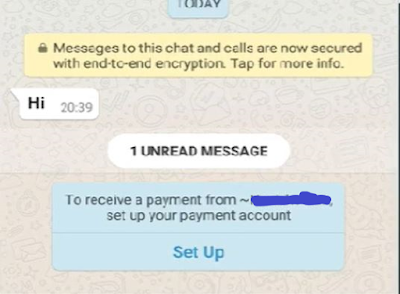

Step 1: The very first thing is 'Update' your Whatsapp when this feature will be launched. Then open the in-chat window of any friend to check the 'Payment' option is visible or not. If it is visible then well and good but if it is not showing then ask any of your friends to send a request who has the 'Payment' option visible on their phone. In your chat window, your friend has to click on 'Payment' and send you a request for payment as shown below.

Step 2: The 'Payment' option will be visible as given below. In-chat window user has to click on the 'Attachment' option followed by the 'Payment' option.

Step 3: Click on "Accept and continue".

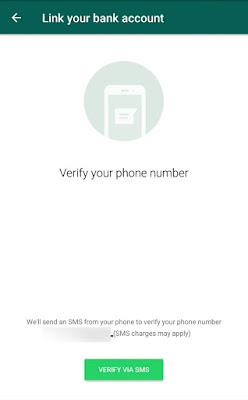

Step 4: After accepting, Link your bank account via SMS verification. An auto-generated message will be sent which will be chargeable. You have note one thing that if you have two SIM cards inserted in your phone then it will ask you to select that SIM which is registered with your bank account.

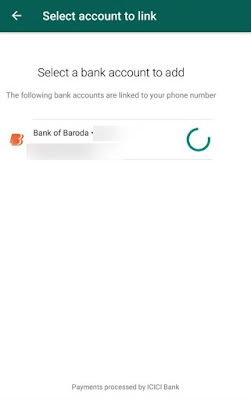

Step 5: Select your bank from the list.

Step 6: After selecting your bank, it will automatically detect your account number linked to your mobile number. It will ask you to add the bank account.

Step 7: This is how your bank account will be linked to your Whatsapp account. Make sure you will be having a UPI feature enabled with your bank account. If it is not enabled then generate UPI PIN first because after that within a few steps you would be able to send or receive money.

Step 4: After accepting, Link your bank account via SMS verification. An auto-generated message will be sent which will be chargeable. You have note one thing that if you have two SIM cards inserted in your phone then it will ask you to select that SIM which is registered with your bank account.

Step 5: Select your bank from the list.

Step 6: After selecting your bank, it will automatically detect your account number linked to your mobile number. It will ask you to add the bank account.

Step 7: This is how your bank account will be linked to your Whatsapp account. Make sure you will be having a UPI feature enabled with your bank account. If it is not enabled then generate UPI PIN first because after that within a few steps you would be able to send or receive money.

How to send money through Whatsapp pay India?

Step 1: Click on the "Attachment" for android users and the "+" symbol for iOS users.

Step 2: Click on the "Payment" option which would be having a '₹' symbol.

Step 3: Enter the amount. You can also send a message attached to the amount.

Step 4: It will redirect you to the UPI interface. Put UPI PIN and money will transfer.

It's really easy to send money through Whatsapp. Once you setup your bank account then within 4 steps you can send money to your contact list. You can also see the summary of the payment by clicking on the money sent.

What is Whatsapp pay India maximum amount limit?

A user can send a maximum of 1 lakh rs in a day. Money can be sent 20 times either to multiple VPAs or to a single VPA (Virtual Payment Address).

Controversies in Whatsapp pay India launch

As mentioned above already NGO and CASC had already filed a plea about data localization norms of RBI. Whatsapp has 400 million users in India and around 2 billion users worldwide, hence it can get more traffic than any other digital payment service company in India. It will be a competition for giant companies like Paytm, PhonePe, Google pay, Mobikwik, Amazon Pay, etc. Currently Paytm is the top digital service provider company in India.

The founder of Paytm Mr. Vijay Sharma raised a few questions about their 'Open ATM' facility, security, affiliation details. Many of the digital payments companies members such as Mobikwik's CEO Bipin Singh, Freecharge's Former chief executive Kunal Shah have supported Mr. Vijay Sharma.

Conclusion

So by the end of May 2020, the Whatsapp pay India feature will be enabled to its 400 million users in India. After a lot of time, struggle, controversies this feature will boost the 'Digital India' movement and make people pay digitally. Because of its massive number of users, it is assumed that it will acquire most of the traffic of digital payment services which will affect a competitor's business too.

If you have any queries related to this article you can comment below. You can also check a trick to show Whatsapp status to the selected contacts.

Leave a Comment